Insurance Clam Paid Decductable Taken Out Recoverable Depresiation Paid Dectuctable Takne Out Again

- Get link

- X

- Other Apps

Property crimes, unforgiving storms, and insurance claims are some of homeowners' biggest concerns, and one out of every 20 insured homeowners files dwelling insurance claims each yr. Afterward experiencing holding damage, y'all already have plenty to worry about—repairing your damaged home, protecting your personal belongings, providing for your family unit—and now you take to navigate your homeowners insurance policy, too. If y'all accept to file an insurance claim, you probably have a lot of questions.

Will your insurance company pays for the full replacement cost of your damaged property? Or will your reimbursement only comprehend the actual cash value of your damaged items? Will you even receive compensation afterward you lot pay your deductible?

The homeowners insurance claims procedure is complicated, but Insurify is here to provide clarity in the confusion.

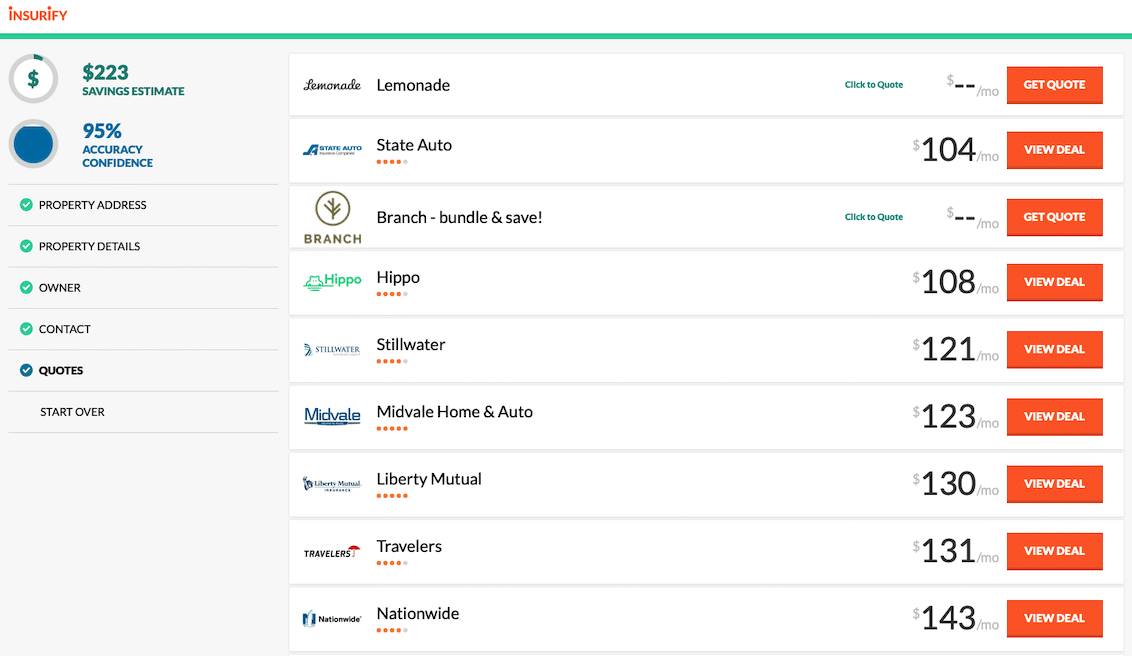

Ideally, yous should know the ins and outs of your policy earlier you demand to file a merits. Merely if the claims process has y'all feeling unsatisfied with your current home insurance policy, Insurify is here to aid with that, as well. Employ our dwelling house insurance comparison tools to explore insurance quotes and coverage options to discover the best policy for yous in merely minutes.

And go on reading to larn how to go the most out of your insurance claim payment.

How does recoverable depreciation work?

Habitation insurance policies fall under i of two categories: they either provide replacement price value (RCV) coverage or actual cash value (ACV) coverage. The first step in estimating how much to expect from an insurance payout is determining which type of policy you have.

Later belongings damage occurs, ACV policies pay for the value of the items prior to becoming damaged. The estimated cost of the items depends on factors similar the amount of fourth dimension yous've owned them, as well as the amount of habiliment and tear on the items.

Let'due south say you lot purchased a laptop for $500 and near laptops have an average lifespan of three to five years. If someone breaks into your habitation and damages your laptop iii years after you bought information technology, your ACV policy won't reimburse you for the total $500 you initially paid for the laptop. Instead, it will pay for the depreciated value of the laptop. Since the laptop had nearly reached its useful life at the time of the loss, you volition likely only be reimbursed a few hundred dollars, if anything.

If you have a replacement cost policy, on the other paw, your insurer will pay for the bodily cash value of your damaged property as well as the depreciation amount. This is known as recoverable depreciation considering that's exactly what information technology is––the amount of depreciation (or lost value) that you can recover (or be reimbursed for).

It's important to note that recoverable depreciation is merely available to policyholders with replacement cost coverage. This is because recoverable depreciation is the corporeality of money that covers the difference betwixt your damaged property's actual cash value and its replacement cost.

And then policyholders with replacement price coverage are reimbursed for their items' actual cash value plus the depreciated value. In contrast, policyholders with ACV coverage are only reimbursed for the actual cash value of their holding.

Claiming Recoverable Depreciation

For policyholders with replacement toll coverage, filing an insurance merits is just the showtime stride in securing your full reimbursement.

When y'all file a claim, your insurer calculates the individual costs associated with your reimbursement (your damaged items' replacement cost value, depreciated value, and actual cash value). Insurance companies mostly calculate an item's bodily cash value based on its initial cost, its expected lifespan, and the amount of time you lot owned the item earlier information technology was damaged.

Permit's say you face roof damage from the weight of snowfall after a storm. You paid $6,000 for the roof five years agone and––if the roof didn't cave in from the snowfall––its lifespan was 20 years. The value of a $6,000 roof with a twenty-year lifespan will depreciate past $300 per year. Once the roof reaches its 20-year lifespan, its value is $0. It'southward pretty elementary.

So if this roof is damaged after v years, its value depreciated by $1,500 earlier the damage. This means that its recoverable depreciation is $1,500. It also means that the roof'due south actual cash value is now $iv,500.

Your insurer will and so distribute your cyberspace merits payment. This payment is your replacement cost value ($6,000 for the roof) minus depreciation ($one,500) and minus your deductible (typically effectually $i,000), leaving you lot with a $3,500 cheque to begin repairing your roof.

This payment is equal to the full amount that a policyholder with an bodily cash value policy would receive for the same claim. There are still a few more steps earlier you tin reap the full benefits of replacement cost coverage.

To receive your recoverable depreciation––which is typically paid separately from your internet merits––you demand to pay to repair or replace your damaged items and prove your insurer proof of payment. After your insurance visitor verifies your repair and replacement costs, the company will send y'all a check for your recoverable depreciation. In the instance of the damaged roof, this is $1,500. Keep in mind that y'all have to cover your $i,000 deductible before your insurance policy kicks in, so this payout only leaves yous with $five,000 to replace your $half-dozen,000 roof.

It's too of import to call up that if the cost of replacing your damaged items is less than your coverage limit, your insurer will only reimburse you for the cost that you lot paid to repair your items. This means that if it just costs yous $4,000 to repair your roof, you will only receive a $4,000 reimbursement (minus your deductible, of course).

Not-Recoverable Depreciation

Not-recoverable depreciation refers to the same decreased value of your damaged items as recoverable depreciation, except in this case, you can't be reimbursed for this amount.

This is the case for ACV policies, where an item'due south depreciation but isn't paid dorsum. In ACV policies, an item's non-recoverable depreciation is always equal to its full depreciation. But there are levels of non-recoverable depreciation in RCV policies, likewise.

Some RCV policies will exclude recoverable depreciation for certain items or perils, so your insurance company will either reimburse the ACV of those items (rather than the RCV) or may non cover them at all.

Basically, your replacement cost policy might non actually provide total replacement cost coverage for all of your items all of the fourth dimension. Talk with your insurance agent to see what type of coverage your policy includes and what information technology doesn't. That manner, you won't get stuck paying out of pocket for repair costs that you idea your policy covered.

Even so take questions? Nosotros know. That's why Insurify compiled our answers to some of homeowners' most often asked questions. (You tin thank us later.)

Overpaying for habitation insurance?

Frequently Asked Questions - Recoverable Depreciation

Why is my insurer saying I can't claim recoverable depreciation?

Some RCV policies accept exclusions for recoverable depreciation. These exclusions can range from sure items to different perils that insurance policies don't cover. If your damaged item isn't included in your coverage or an excluded peril acquired the damage, you may even so be able to file an insurance claim (and receive an ACV reimbursement), merely y'all won't be able to merits recoverable depreciation.

How does recoverable depreciation for roof replacement work?

Claiming recoverable depreciation works the aforementioned way regardless of the holding you need to repair. You lot submit your claim, pay for repairs, and send your receipts to your insurance company. And so, your insurer will send a check for any recoverable depreciation you authorize for.

Who gets the recoverable depreciation check?

Yous! When a policyholder submits a recoverable depreciation claim, the insurer sends the check straight to the policyholder as reimbursement for any repair or replacement costs.

Recoverable Depreciation: The Bottom Line

The insurance claims process tin can feel overwhelming, especially if it'south your first fourth dimension filing a claim. But understanding your policy will help you get the virtually from your replacement cost coverage. Once y'all know how to secure recoverable depreciation, you can get back to fixing (and enjoying) your home again.

And if filing a claim left you feeling underwhelmed with your current dwelling insurance policy, employ Insurify's comparison tools to detect the best home insurance providers in no time.

Compare Quotes For Free

Compare & Save Today.

Updated June 4, 2021

Jacklyn Walters is a freelance writer for Insurify. Jacklyn has a background in journalism and is passionate most informing and serving others through writing. In her spare time, Jacklyn enjoys running, practicing yoga, and writing music.

Insurance Clam Paid Decductable Taken Out Recoverable Depresiation Paid Dectuctable Takne Out Again

Source: https://insurify.com/blog/home-insurance/recoverable-depreciation/

- Get link

- X

- Other Apps

Comments

Post a Comment